Navigating the World of Home Decor Products: A Comprehensive Guide to Harmonized System (HS) Codes

Related Articles: Navigating the World of Home Decor Products: A Comprehensive Guide to Harmonized System (HS) Codes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Home Decor Products: A Comprehensive Guide to Harmonized System (HS) Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Home Decor Products: A Comprehensive Guide to Harmonized System (HS) Codes

The world of home decor is a vibrant tapestry woven with countless threads, each representing a unique product category. To effectively manage and categorize these diverse items for international trade, a standardized system known as the Harmonized System (HS) Code is employed. This article delves into the intricacies of HS Codes specifically applied to home decor products, providing a comprehensive understanding of their structure, application, and significance in the global marketplace.

Understanding HS Codes: A Foundation for Global Trade

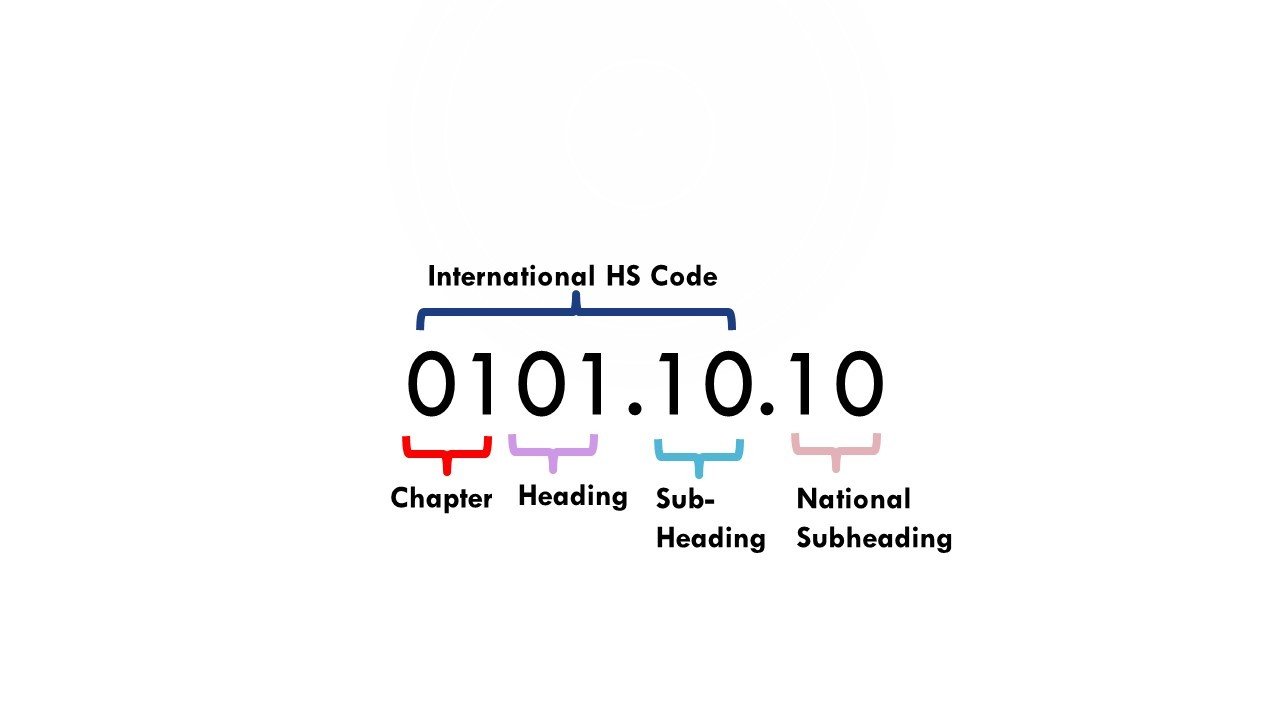

HS Codes are a six-digit numerical classification system used worldwide to identify and classify traded goods. Developed by the World Customs Organization (WCO), this system ensures uniformity and clarity in international trade practices. Each HS Code represents a specific product category, enabling customs officials, importers, and exporters to accurately identify and track goods across borders.

Navigating the Hierarchy of HS Codes: A Breakdown of Home Decor Categories

Within the broader HS Code framework, home decor products fall under various categories, each with its unique code. This intricate hierarchy allows for precise identification and classification of even the most specific items.

Chapter 94: Furniture, Bedding, Lamps, etc.

The primary chapter encompassing home decor products is Chapter 94, titled "Furniture; Bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; Lamps and lighting fittings, not elsewhere specified or included." This chapter houses a wide array of home furnishings, including:

- 9401: Furniture of wood

- 9402: Furniture of metal

- 9403: Furniture of other materials

- 9404: Mattresses, mattress supports, cushions and similar stuffed furnishings

- 9405: Lamps and lighting fittings

Sub-headings and Tariff Codes: Refining the Classification

Within each chapter, further categorization occurs through sub-headings and tariff codes. These additional digits provide a more specific classification, enabling accurate identification of individual products. For instance, under Chapter 94, "9401.10.00" might represent "Furniture of wood, for bedrooms," while "9402.90.00" could denote "Furniture of metal, other."

The Significance of HS Codes: Beyond Classification

The importance of HS Codes extends far beyond mere categorization. They play a crucial role in:

- Tariff Determination: HS Codes are directly linked to tariffs, the taxes levied on imported goods. Understanding the correct HS Code for a specific product ensures accurate tariff calculation, preventing financial discrepancies.

- Trade Statistics: HS Codes are essential for tracking trade data, providing insights into global trade patterns and market trends. This data is crucial for businesses to make informed decisions regarding sourcing, production, and distribution.

- Customs Clearance: HS Codes facilitate smooth customs clearance by providing a standardized language for communication between importers, exporters, and customs authorities. This streamlined process minimizes delays and ensures efficient movement of goods across borders.

- Compliance and Regulations: HS Codes are used to enforce trade regulations and ensure compliance with international standards. They help prevent the import of prohibited or restricted items and promote fair trade practices.

Navigating the Complexity: Resources and Tools

The intricate nature of HS Codes can be daunting for businesses unfamiliar with the system. Fortunately, various resources and tools are available to aid in navigating this complex landscape:

- World Customs Organization (WCO): The WCO website provides comprehensive information about the HS Code system, including the official nomenclature and updates.

- National Customs Agencies: Each country’s customs agency offers specific guidance and resources on HS Code usage within their jurisdiction.

- Trade Associations: Industry-specific trade associations often provide valuable resources and expertise on HS Codes relevant to their respective sectors.

- Specialized Software: Software solutions designed for international trade can automate HS Code lookup and classification, streamlining the process for businesses.

FAQs: Addressing Common Questions

Q: How do I find the correct HS Code for my product?

A: The most accurate method is to consult the official HS Code nomenclature provided by the World Customs Organization (WCO). You can also utilize online databases or specialized software solutions for assistance.

Q: Why is it crucial to use the correct HS Code?

A: Incorrect HS Codes can lead to incorrect tariff calculations, delays in customs clearance, and potential legal issues. Using the correct code ensures compliance and smooth trade operations.

Q: What happens if I use the wrong HS Code?

A: Customs authorities may reject your shipment, leading to delays and potential penalties. You may also face financial repercussions due to incorrect tariff payments.

Q: Can I change the HS Code once my goods have been shipped?

A: Generally, it is not possible to change the HS Code after goods have been shipped. It is crucial to ensure the accuracy of the code before shipment.

Tips for Effective HS Code Management

- Stay Informed: Keep abreast of changes and updates to the HS Code system.

- Consult Experts: Seek guidance from customs brokers, trade associations, or specialized software providers for assistance with complex classifications.

- Maintain Records: Keep detailed records of all HS Codes used for your products, including the source of information.

- Review Regularly: Periodically review your HS Code usage to ensure accuracy and compliance with current regulations.

Conclusion: HS Codes – A Cornerstone of Global Trade

HS Codes are an indispensable tool for managing and facilitating global trade in home decor products. By providing a standardized language for classification, they ensure accurate tariff determination, streamlined customs clearance, and compliance with international regulations. Businesses involved in the home decor industry must prioritize understanding and utilizing HS Codes effectively to navigate the complexities of international trade and achieve success in the global marketplace.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Home Decor Products: A Comprehensive Guide to Harmonized System (HS) Codes. We thank you for taking the time to read this article. See you in our next article!