The Rise of Flexible Financing: How Buy Now, Pay Later is Transforming Home Decor Retail

Related Articles: The Rise of Flexible Financing: How Buy Now, Pay Later is Transforming Home Decor Retail

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Rise of Flexible Financing: How Buy Now, Pay Later is Transforming Home Decor Retail. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Rise of Flexible Financing: How Buy Now, Pay Later is Transforming Home Decor Retail

:max_bytes(150000):strip_icc()/buy-now-pay-later-5182291-final-4dcaa9bea32a4aa398eb99e5ca5406bb.png)

The home decor industry, traditionally known for its high-ticket items and cyclical purchase patterns, is undergoing a significant transformation. This shift is fueled by the increasing adoption of buy now, pay later (BNPL) payment options, which are rapidly becoming a preferred method for consumers seeking greater financial flexibility and control over their spending.

Understanding the Dynamics of Buy Now, Pay Later in Home Decor

Buy now, pay later solutions empower consumers to make purchases without having to pay the full amount upfront. Instead, they can split the cost into manageable installments, often with no interest charges. This approach appeals to a wide range of demographics, from young adults starting their first homes to established families looking to refresh their interiors.

The Appeal of Buy Now, Pay Later for Home Decor Consumers

The popularity of BNPL in home decor can be attributed to several key factors:

- Accessibility: BNPL solutions are widely available, integrated into online retailers and even offered in-store through point-of-sale terminals. This ease of access makes it a convenient option for consumers who may not have access to traditional credit or prefer to avoid using their credit cards.

- Budget Control: BNPL allows consumers to spread the cost of their purchases over time, making it easier to manage their budgets and avoid overspending. This is especially beneficial for larger home decor items, such as furniture, appliances, or renovations.

- Improved Affordability: The ability to pay in installments makes luxury or high-end home decor items more accessible to a wider range of consumers. This can lead to increased sales and customer satisfaction.

- Flexible Payment Options: BNPL solutions offer various payment schedules and durations, giving consumers the flexibility to choose a plan that suits their financial situation.

- Enhanced Customer Experience: By offering BNPL, home decor retailers can create a more seamless and convenient shopping experience for their customers. This can lead to increased customer loyalty and repeat purchases.

Benefits for Home Decor Retailers

The adoption of BNPL by home decor retailers is not just a response to consumer demand; it also offers several tangible benefits:

- Increased Sales: BNPL can drive sales by making purchases more accessible to a wider customer base. This is particularly relevant for high-ticket items where the upfront cost can be a barrier to purchase.

- Improved Conversion Rates: By offering a flexible payment option, retailers can increase conversion rates, as consumers are more likely to complete their purchases when they have the option to pay over time.

- Increased Average Order Value: BNPL can encourage consumers to purchase more expensive items or add additional items to their basket, leading to higher average order values.

- Enhanced Customer Loyalty: By providing a convenient and flexible payment option, retailers can foster greater customer satisfaction and loyalty.

- Competitive Advantage: In a competitive marketplace, offering BNPL can differentiate retailers and attract customers who value financial flexibility.

Addressing Concerns and Challenges

While BNPL offers numerous advantages, there are also some concerns and challenges that need to be addressed:

- Potential for Overspending: While BNPL can help manage budgets, there is a risk of consumers overspending if they are not careful with their spending habits.

- High Interest Rates: Some BNPL providers charge high interest rates if payments are missed or delayed. This can lead to debt accumulation if not managed responsibly.

- Data Privacy Concerns: BNPL providers collect personal and financial data from their users. This data must be protected securely to prevent breaches and ensure consumer privacy.

Navigating the Landscape of BNPL Providers

The BNPL landscape is rapidly evolving, with a growing number of providers entering the market. Home decor retailers need to carefully evaluate and select the right provider based on factors such as:

- Fees and Interest Rates: Compare the fees and interest rates charged by different providers to ensure they are transparent and competitive.

- Payment Terms: Consider the available payment terms, including the number of installments and the repayment period.

- Integration with Existing Systems: Choose a provider that seamlessly integrates with your existing point-of-sale systems and online platforms.

- Customer Support: Ensure the provider offers excellent customer support to assist customers with any questions or issues they may have.

FAQs on Buy Now, Pay Later in Home Decor

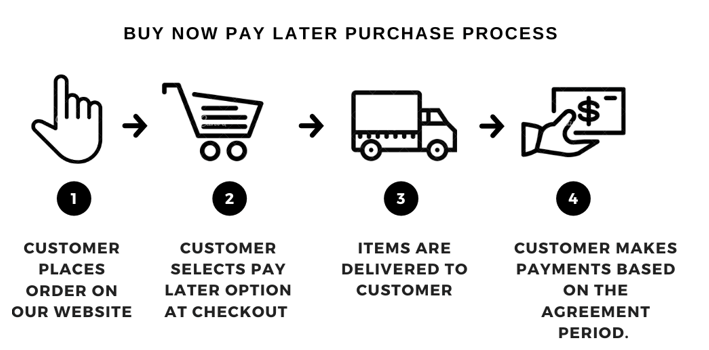

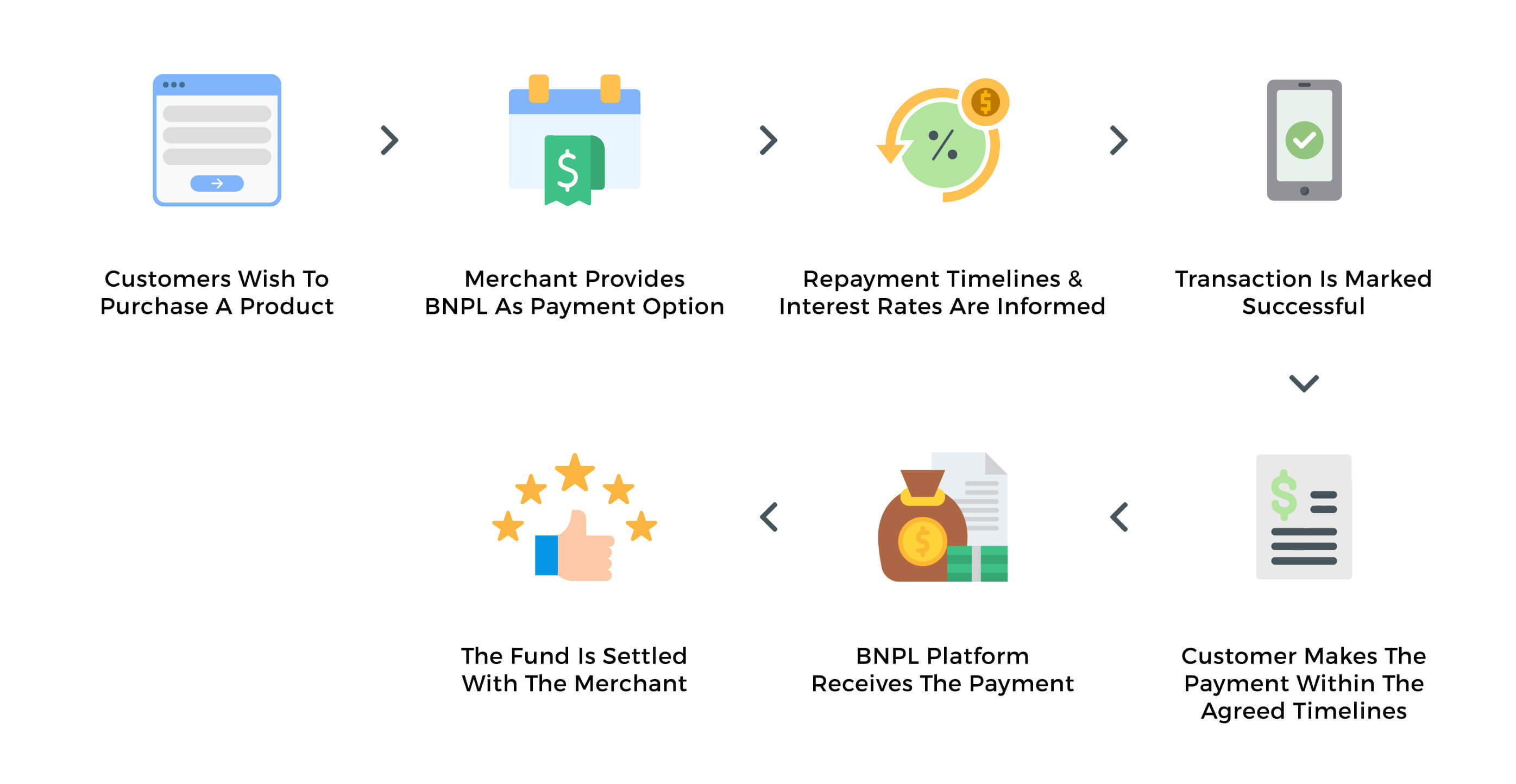

Q: How does Buy Now, Pay Later work in home decor stores?

A: Buy Now, Pay Later (BNPL) allows consumers to purchase home decor items without paying the full amount upfront. Instead, they can split the cost into manageable installments, typically with no interest charges. These installments are paid over a predetermined period, usually within a few weeks or months.

Q: What are the benefits of using Buy Now, Pay Later for home decor purchases?

A: BNPL offers several benefits for consumers, including:

- Accessibility: It makes expensive home decor items more affordable by spreading the cost over time.

- Budget Control: It allows consumers to manage their spending and avoid overspending on large purchases.

- Flexibility: It provides a convenient way to pay for purchases without using a credit card or taking out a loan.

Q: Are there any risks associated with Buy Now, Pay Later?

A: While BNPL offers convenience, there are potential risks:

- Overspending: It can encourage impulsive purchases if not used responsibly.

- High Interest Rates: Some providers charge high interest rates if payments are missed or delayed.

- Data Privacy: BNPL providers collect personal and financial data, which needs to be protected securely.

Q: How can I choose the right Buy Now, Pay Later provider for my home decor purchases?

A: When choosing a BNPL provider, consider factors such as:

- Fees and Interest Rates: Compare fees and interest rates to find the most competitive option.

- Payment Terms: Assess the available payment terms, including the number of installments and repayment period.

- Integration: Ensure the provider integrates seamlessly with your existing systems.

- Customer Support: Check the provider’s customer support options and reputation.

Tips for Retailers Implementing Buy Now, Pay Later

- Educate Customers: Clearly explain the benefits and terms of BNPL to ensure customers understand the program.

- Promote the Option: Highlight BNPL as a payment option at checkout and in marketing materials.

- Monitor Performance: Track the performance of BNPL to identify areas for improvement and optimize its effectiveness.

- Partner with Reputable Providers: Choose reputable BNPL providers with a strong track record and commitment to consumer protection.

Conclusion

Buy Now, Pay Later is transforming the home decor industry by offering consumers greater financial flexibility and affordability. This trend is expected to continue as consumers increasingly seek convenient and accessible payment options. Retailers who embrace BNPL can reap the benefits of increased sales, improved conversion rates, and enhanced customer loyalty. By understanding the dynamics of BNPL and addressing potential concerns, retailers can effectively leverage this innovative payment solution to drive growth and success in the competitive home decor market.

Closure

Thus, we hope this article has provided valuable insights into The Rise of Flexible Financing: How Buy Now, Pay Later is Transforming Home Decor Retail. We thank you for taking the time to read this article. See you in our next article!